Supply

Fill-up records

du

1stau

5thvehicle

Billing rate(1)

8% of the amount to be recover

Minimum flat rate(2)

10€ excl. VAT

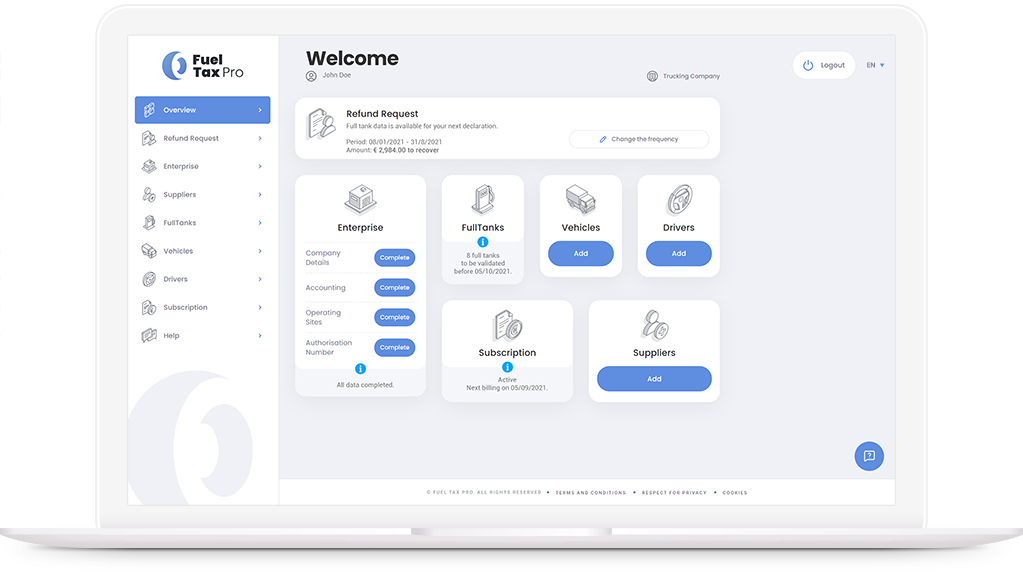

Easily collect your fuel data and generate with a single click the excise duties refund requests related to your professional diesel supplies in Belgium.

Reach new records in terms of cost reduction and profitability.

Start by encoding your company data and by registering your fleet.

Let FuelTax Pro handle your excise duties refund requests subsequently.

Adjust your vehicle and driver lists according to the evolution of your activities.

Easily monitor your consumption, refunds and invoices.

The FuelTax Pro tariff plan, designed to dynamically adapt to your activity on a monthly basis, applies to each vehicle individually, according to its monthly fuel supply.

Create your account and take advantage of the sliding scale rate plan below applied monthly to each vehicle in your fleet.

For more information, please refer to our FAQs.

Fill-up records

Supply

Billing rate(1)

Minimum flat rate(2)

Supply

Fill-up records

du

1stau

5thvehicle

Billing rate(1)

8% of the amount to be recover

Minimum flat rate(2)

10€ excl. VAT

Supply

Fill-up records

du

6thau

25thvehicle

Billing rate(1)

7% of the amount to be recover

Minimum flat rate(2)

10€ excl. VAT

Supply

Fill-up records

du

26thau

99thvehicle

Billing rate(1)

6% of the amount to be recover

Minimum flat rate(2)

10€ excl. VAT

Supply

Fill-up records

from

100thvehicle

Billing rate(1)

5% of the amount to be recover

Minimum flat rate(2)

10€ excl. VAT

Supply

Invoices

fuel cards, tanks, etc.

Billing rate(1)

5% of the amount to be recover

Minimum flat rate(2)

10€ excl. VAT

(1) Calculated on the basis of the amounts of excise duties to be recovered as mentioned at the end of each month on your excise refund request form generated by Fuel Tax Pro. For invoicing purposes, the vehicles of your fleet will be sorted in decreasing order of monthly diesel supply and subsequently invoiced at the declining invoicing rates, from the most supplied vehicles to the least supplied vehicles.

(2) Minimum flat rate per vehicle for vehicles having registered at least one full tank during the month. Vehicles not having registered a full tank, haven’t been invoiced.